We recognise claims costs can rise significantly as a result of uncontrolled third-party claims. We work alongside our clients insurers to proactively assist in managing repairs and providing courtesy cars or other replacement vehicle solutions.

Claim mitigation for car accidents involves taking steps to minimise the impact of damages and losses after the accident.

Here are some key actions to consider:

Dash Claims plays a crucial role in claim mitigation by providing comprehensive support and services to minimise the impact of accidents.

Here are some key aspects of how we help:

Immediate Response:

Dash Claims offer a 24/7 accident hotline to provide immediate assistance, reducing downtime and frustration. Accidents can happen at any time of the day, we are here for you when you need us.

Efficient Claims Handling:

Managing the entire claims process, from initial notification to settlement. Dash Claims ensures a streamlined and efficient experience. By managing every step of the process, we can help keep the costs of the claim down to a minimum. Non-fault claims should never be about running up massive bills for 3rd party insurers.

At Dash Claims we don’t and never will operate using any underhanded claims processes. Dash Claims wants to offer an alternative claims process that works to benefit our clients.

Professional Repairs:

With access to a network of vetted and approved repair shops, ensures quality and timely repairs. Minimising vehicle downtime. Dash Claims only works with repairers who meet the highest industry standards.

The cheapest repair isn't always the most cost-effective repair.

Only working with Bodyshops who work to the highest industry standards

Emergency Assistance:

Services like roadside assistance and emergency medical support help manage the immediate aftermath of an accident. Dash claims ensure that you, your vehicle, and your passengers are safely recovered from the scene of the accident. The claims mitigation process starts from your initial call for assistance.

By utilising approved recovery operators, we can manage recovery and storage costs from day 1 of your claim. We specialise in keeping claims cost down, we want your claim to cost as little as possible to the 3rd party insurers.

By utilising a First Notification Of Loss (FNOL) process early in the claims process Dash Claims can work alongside 3rd party insurers to help keep claims costs from spiralling out of control.

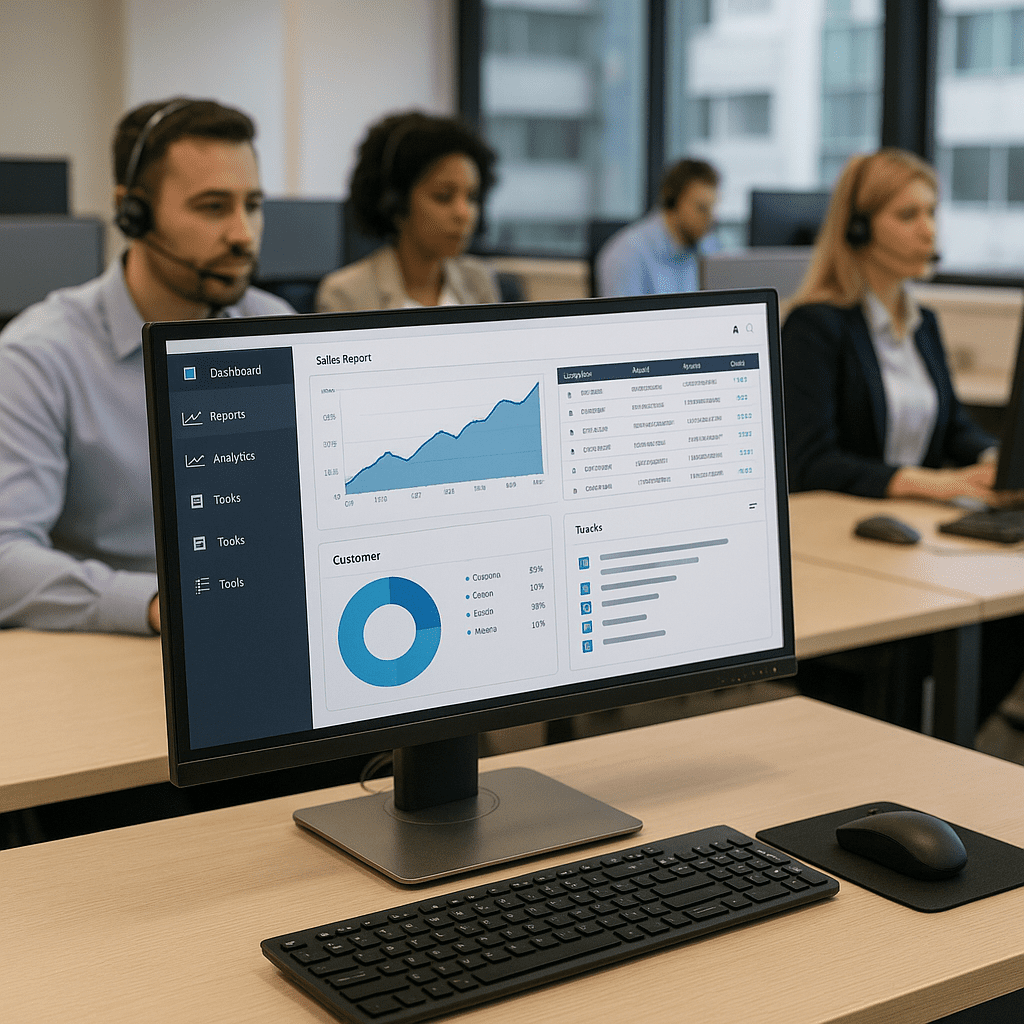

Documentation and Reporting:

Digital tools for incident reporting and documentation accelerate the claims resolution process and reduce the risk of fraud. Dash Claims utilises specialist claims software that sends and collects your claim information all in one location.

The software is used to send work orders & receive updates from work providers. The Kin Claims Smart Software Technology, monitors all traffic and notifies our claims staff about your repair, hire, and solicitor notifications as soon as we receive any updates.

By utilising this state-of-the-art software, we can not only keep all of your personal details safe, but we can streamline your claims process, keeping costs down to a minimum.

Call Dash Claims on 0300 3046300, Text or WhatsApp 07538013786 and we will call you back,

Ready to start your non-fault accident claim?